Rental property owners report satisfaction with real estate investments and plans to continue investing

New research conducted by Benchmark Research Partners and Hemlane of nearly 400 rental property owners across the United States revealed high levels of satisfaction with real estate as an asset class and revealed insight into investment strategies and approaches to property management.

During the 1970s, rental property ownership was a popular investment strategy against the backdrop of high inflation and mediocre stock performance. Today, amidst a cloudy macro outlook that evokes memories of that decade, we wanted to understand how rental property owners view their investments and how they are planning for the future. Below are selected excerpts from the study.

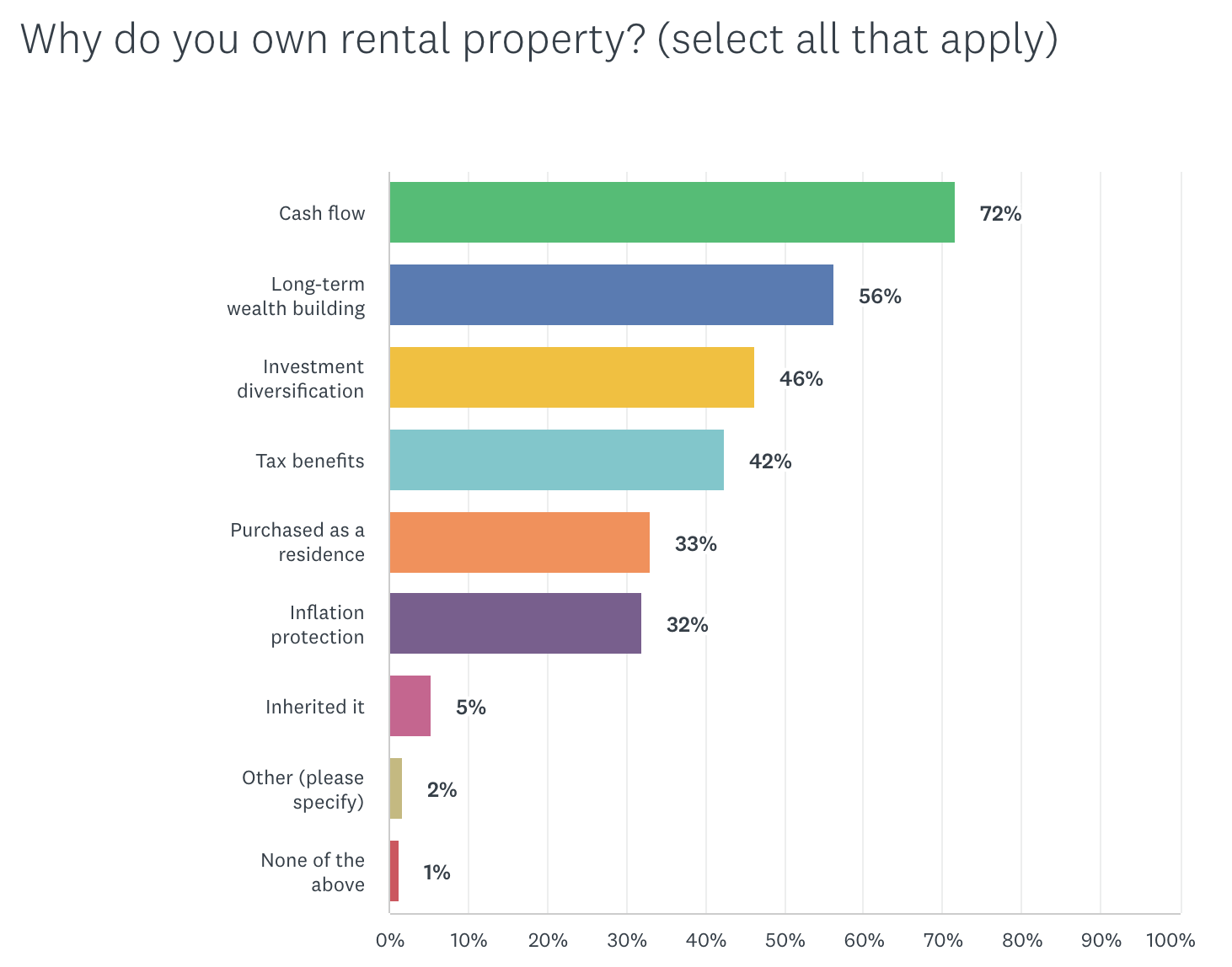

Cash flow tops reasons for rental property ownership

The majority of respondents held more than half of their net worth in real estate, and when asked why, cash flow topped the list of reasons.

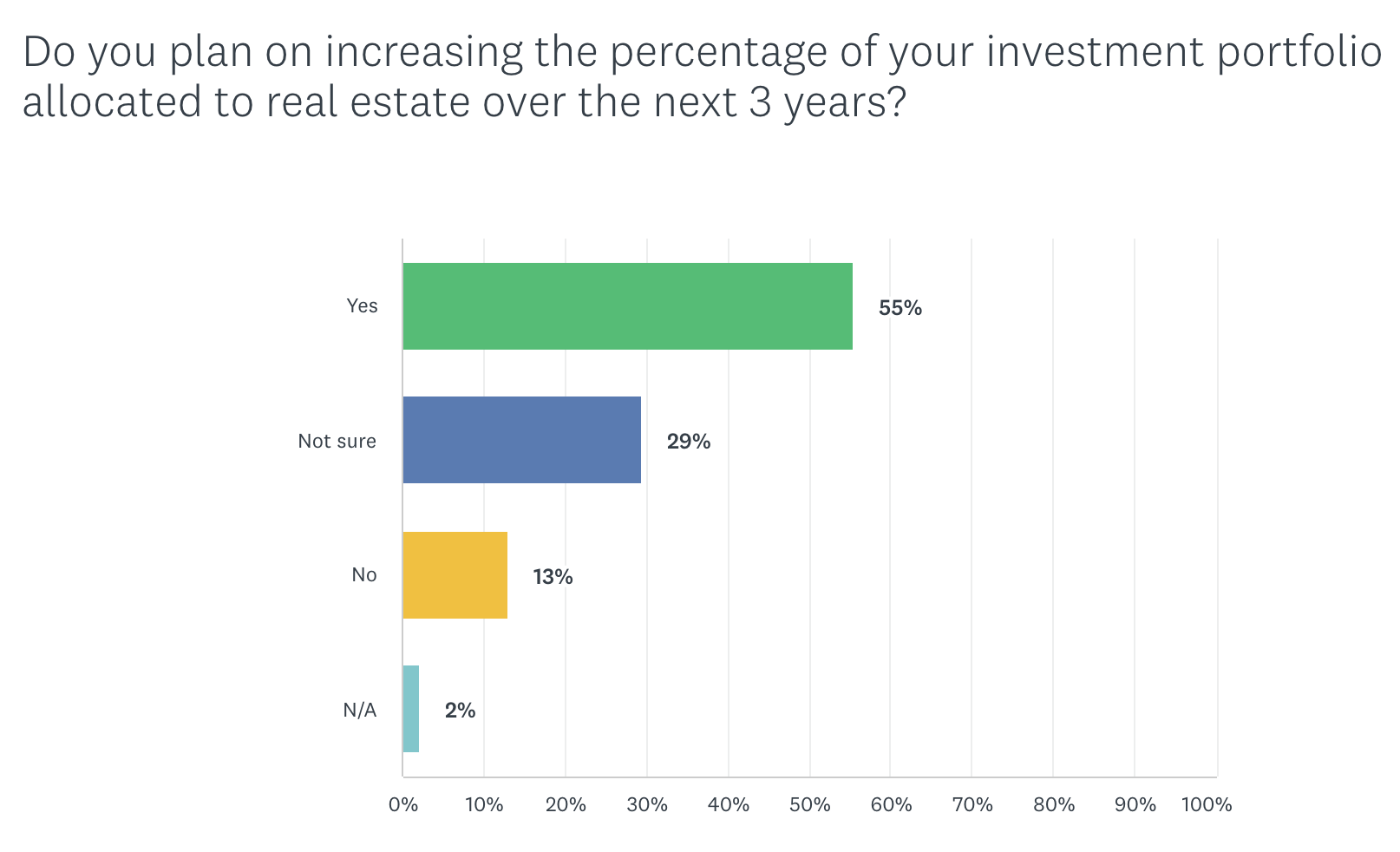

A majority want to increase their allocation to real estate

This signals confidence in the performance, resilience, and potential of this asset class.

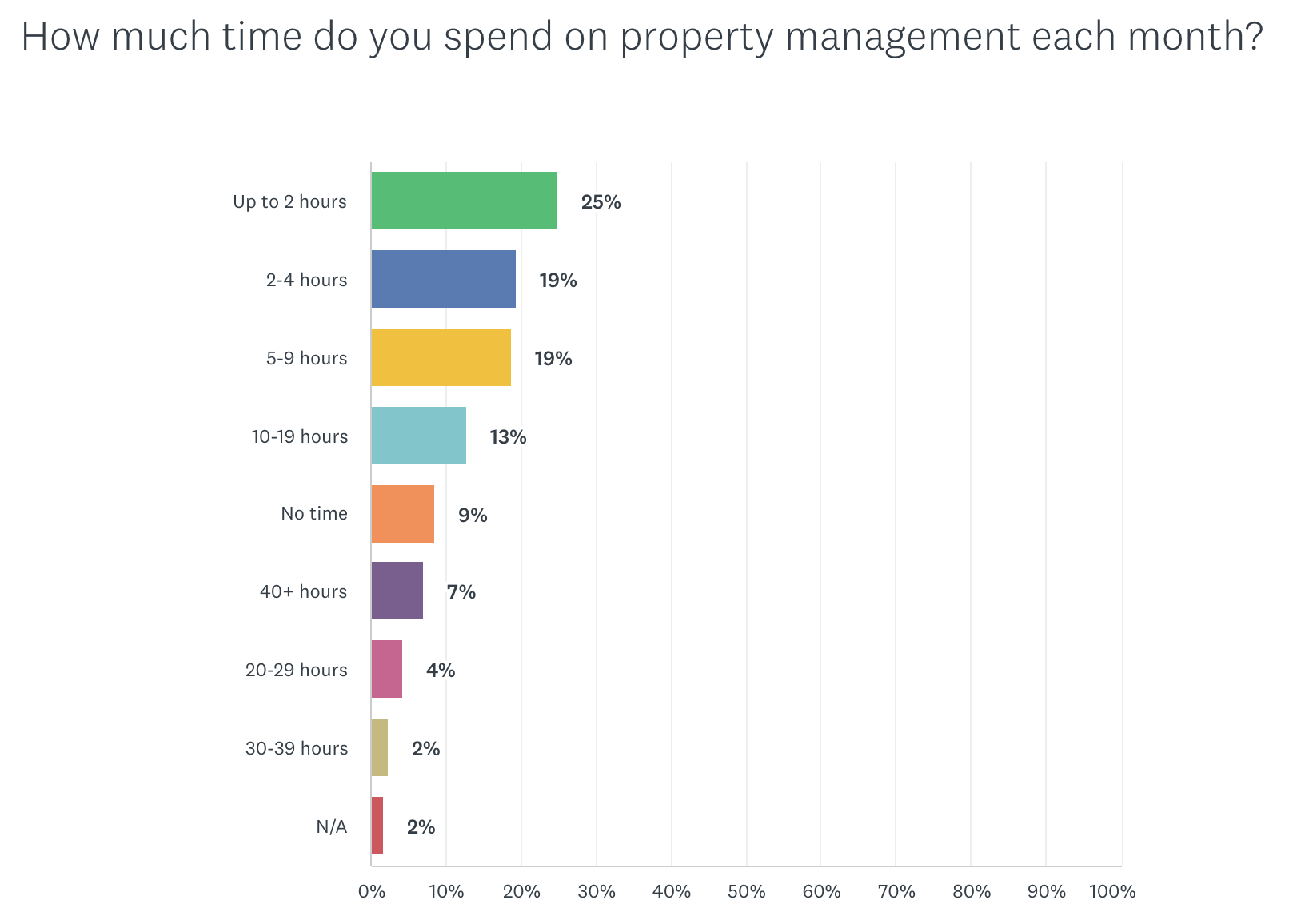

Most rental properties do not require significant management time

Despite the common belief that owning rental property consumes significant time, participants in the study reported their properties only required nominal time to manage.

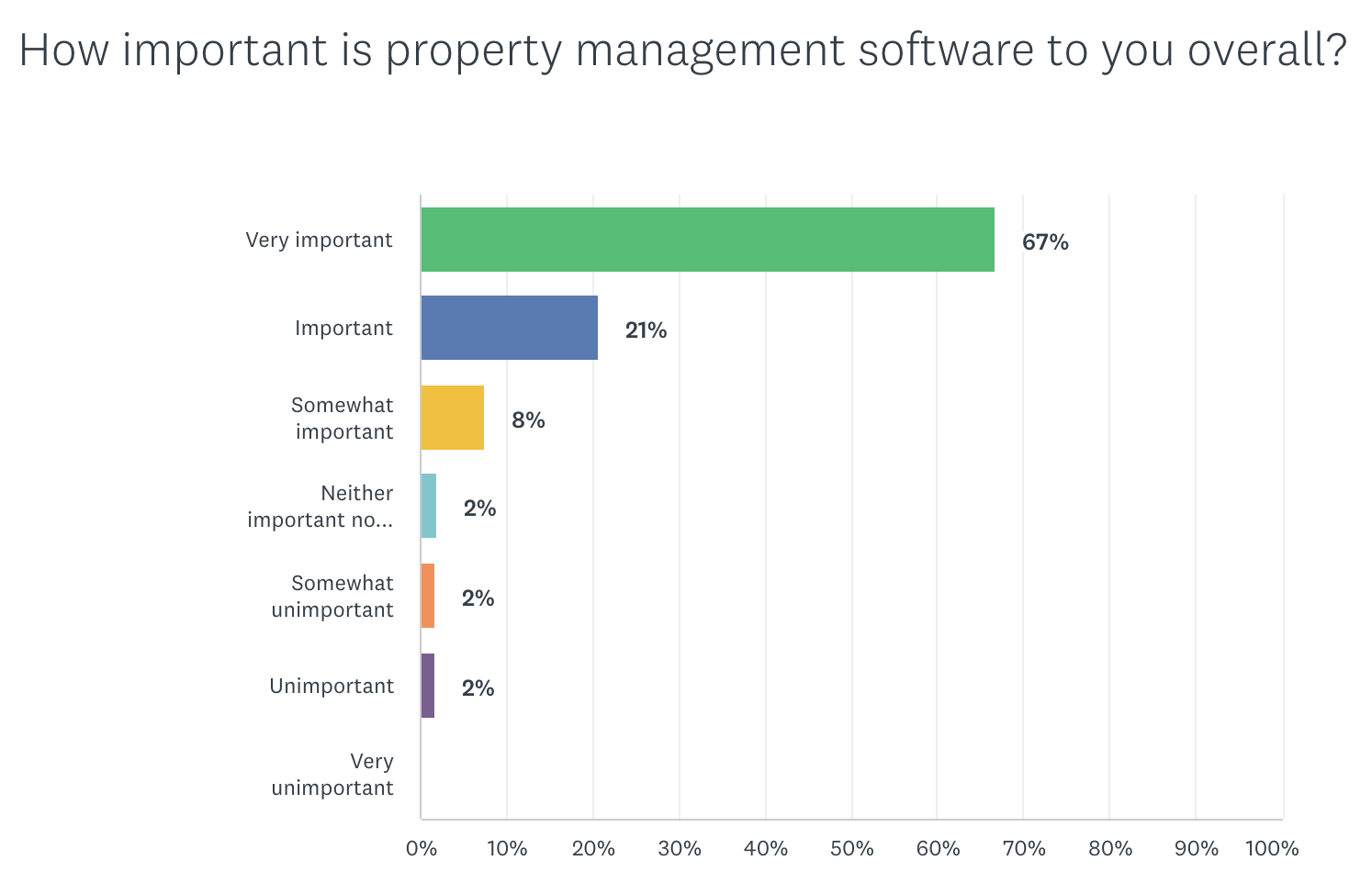

Property owners say technology is important for property management today

One reason property management takes less time than it has in the past could be the use of technology, which many rental owners say is very important to them:

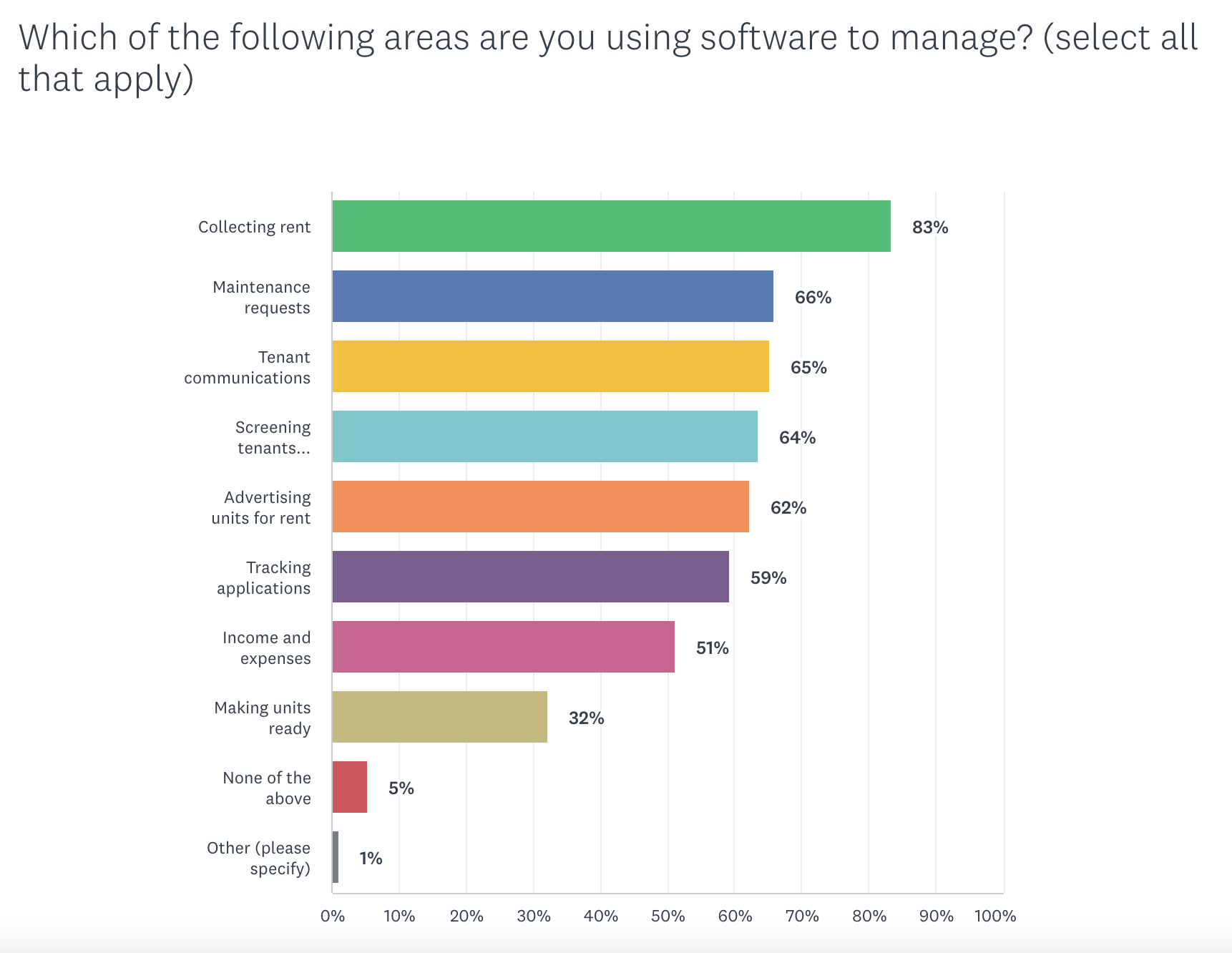

Rental property owners report using software to manage a wide range of activities, from collecting rent to tracking new tenant applications:

Our special report with Hemlane on property management today also provides data points such as average property management fees, profitability, and more. Download the report here.